|

A/R - Curr - Enter A/R Invoices |

|

|

|

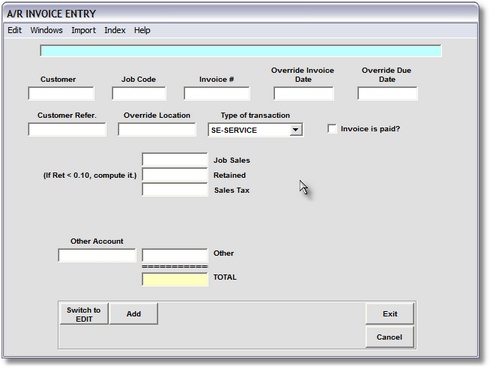

Invoice Entry

A. Getting Started This is a DATA ENTRY PROGRAM

On the A/R and Billing / Enter A/R Activity Menu

select #2 - Enter A/R Invoices.

You will see an Input Screen with EMPTY BOXES. (The file was emptied when

you did the last A/R Input Update).

If you see a filled in record on the screen, it means that:

A. Some entries for this A/R Input Run were made at an earlier time.

(Click on Switch to ADD button to bring up an EMPTY Input Screen)

OR:

B. The LAST A/R INPUT RUN was NOT updated.

Verify that these are the last A/R Input Run's valid entries, then Update & return)

B. Body of A/R Invoice Record.

1. Enter Customer Code REQUIRED ENTRY

Enter a VALID Customer Code, then Click on Job Code or Press TAB key.

If the Code you entered was INVALID you will see the SCAN FOR WINDOW where

you can search for the Correct Code.

If you are not sure of the Customer Code, enter the FIRST LETTER of the FIRST NAME.

Then Press TAB key to bring up SCAN FOR WINDOW.

If the Customer Name is NOT IN THE LIST, you can ADD A NEW CUSTOMER by

clicking on the WINDOWS MENU BAR.

2. Enter Job Code (if this Invoice is to be posted to Job Cost)

Enter a VALID Job Code, then Click on Invoice # or Press TAB key.

If the Code you entered was INVALID you will see the SCAN FOR WINDOW where

you can search for the Correct Code.

If you are not sure of the Job Code, enter the FIRST LETTER (usually indicates

type of Job) Then Press TAB key to bring up SCAN FOR WINDOW.

If the Job Name is NOT IN THE LIST, you can ADD A NEW JOB by clicking on the

WINDOWS MENU BAR ,then clicking on the JOBS selection.

3. Invoice Number REQUIRED ENTRY

Alphanumeric field of up to 10 characters.

This entry is part of the ACCESS CODE that you may later use to FIND this Invoice in the

file or on a Report. Normally you would use a UNIQUE INVOICE NUMBER that you

assigned to this document.

In special cases you may enter NOTES in this field. You CANNOT leave this field BLANK.

4. Override Invoice Date

You will have an opportunity to enter an INVOICE DATE for this ENTIRE BATCH of

of A/R Invoice Entries in the next step, Print and Update Invoices.

If you want to OVERRIDE this BATCH INVOICE DATE and post this Invoice with a

DIFFERENT Invoice Date, enter that Invoice Date in this Input Box.

5.Override Due Date

You will have an opportunity to enter a DUE DATE for this ENTIRE BATCH of

of A/R Invoice Entries in the next step, Print and Update Invoices.

If you want to OVERRIDE this BATCH DUE DATE and post this Invoice with a

DIFFERENT Due Date, enter that Due Date in this Input Box.

6. Override LOCATION

If this Invoice is for work performed at a DIFFERENT SALES LOCATION

than the one setup in the Job Master Record or the Default Location

enter an OVERRIDE SALES LOCATION.

7. Type of Transaction

The DEFAULT Type of Transaction will appear in this Drop Down List Box after

the Customer Code is entered.

TYPE OF TRANSACTION determines the General Ledger SALES, ACCOUNTS RECEIVABLE

and OTHER ACCOUNTS that will be posted for this A/R Invoice Entry.

If this entry is NOT a DEFAULT Type of Transaction (most commonly used), then Click

on the down arrow and select the Type that fits this entry.

If there is no type in the List Box that fits this entry you can ADD a New Type of

Transaction by Clicking on the Windows Menu Bar at top left, then Click on Sales

Transaction Codes.

8. INVOICE IS PAID Check Box

If this A/R Invoice has ALREADY BEEN PAID at time of entry Click on this Check Box

and fill in the PAID DATA ENTRY ITEMS.

C. INVOICE AMOUNT ENTRY BOXES (Sales Transaction Code determines which

Boxes are displayed on Screen for entry).

1. JOB SALES (always displayed)

Gross Job Sales Amount of Invoice.Total Amount of Invoice BEFORE Discount

or Retainage is deducted.

2. RETAINED (always displayed)

Retained Amount for this Invoice, if any.

You can enter an Amount or Percentage in this A/R - Retained field.

3. SALES TAX (always displayed)

Sales Tax Amount for this Invoice, if any.

4. DISCOUNT (only displayed if Type of Transaction is Discount)

Discount Amount for this Invoice

5. INTEREST (only displayed if Type of Transaction is Interest)

Interest Amount for this Invoice

6. OTHER ACCOUNT and AMOUNT (always displayed)

For MISCELLANEOUS NON-JOB Sales Entries. Enter the G/L Account to CREDIT

in the OTHER ACCOUNT Input Box and the Amount of the Sale in the OTHER AMOUNT

Input Box.

D. VERIFY TOTAL INVOICE AMOUNT

See that the TOTAL DISPLAYED in the YELLOW BOX at the bottom of the Amount Input

Boxes MATCHES the TOTAL on the Invoice Document.