|

AR - TYPE TRANSACTION |

|

|

|

REQUIRED ENTRY

A Drop Down List Box that contains ALL THE A/R TRANSACTION TYPES set up in

the Parameters Menu ACCOUNTS RECEIVABLE SALES TRANSACTION CODE FILE.

The purpose of the A/R TYPE OF TRANSACTION entry is to post the PROPER SALES and

ACCOUNTS RECEIVABLE GENERAL LEDGER ACCOUNTS for this particular Invoice. In

Special Cases OTHER G/L ACCOUNTS will be posted as with INTEREST and DISCOUNTS.

After entering the Customer Code the DEFAULT SALES TRANSACTION CODE will be

automatically loaded into this Box. This is the Code MOST COMMONLY USED for A/R

Invoices. If you need a DIFFERENT CODE Click on the List Box Down Arrow and

select the Code you need.

The Sales Transaction Type Code determines WHICH AMOUNT INPUT BOXES appear

on the Screen for Entry. This helps to INSURE that you are using the CORRECT CODE

for rarely used entries.

You can reach this Sales Transaction Type File from the WINDOWS Menu Selection Box

at the top left of the A/R Invoice Input Screen. Here you can ADD or MODIFY Codes as required.

Below are EXAMPLES of these Codes:

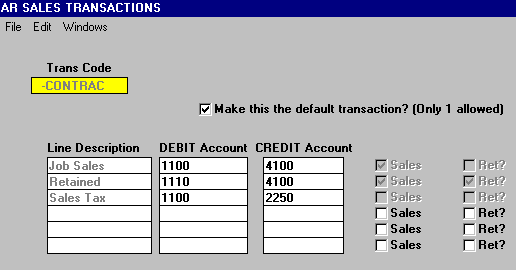

The above Sales Type Transaction Record is for CONTRACT SALES. The hyphen was put in

front to make it appear FIRST in the List Box.

The DEBIT ACCOUNT for Job Sales and Sales Tax is ACCOUNTS RECEIVABLE - TRADE.

The DEBIT ACCOUNT for Retained is ACCOUNTS RECEIVABLE - RETAINED

The CREDIT ACCOUNT for Job Sales and Retained is JOB INCOME - CONTRACT JOBS.

The CREDIT ACCOUNT for Sales Tax is ACCRUED SALES TAX.

The Check Box at upper right indicates that this Sales Type is our MOST COMMONLY USED

ENTRY and has been designated the DEFAULT Sales Type Code. It will appear in EVERY

Invoice Record AUTOMATICALLY unless OVERRIDEN by a selection in the List Box.

The other Check Boxes indicate if this Transaction is a Sales or Retainage item.

Below is an example of a SPECIAL TYPE OF SALES TRANSACTION Record.

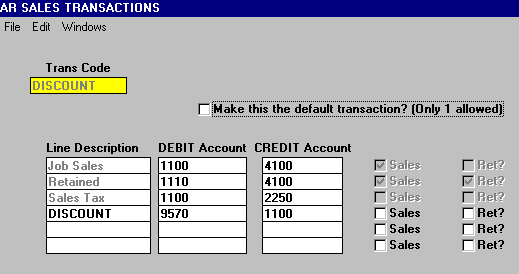

This Sales Type Transaction Record is for Invoices with DISCOUNTS ALLOWED.

Note the ADDITIONAL LINE at bottom for the DISCOUNT Entry. This will cause an EXTRA INPUT

BOX to appear on the A/R Invoice Entry Screen, labeled DISCOUNT.

The DEBIT ACCOUNT for Discount is DISCOUNTS ALLOWED, an OTHER EXPENSE ACCOUNT..

The CREDIT ACCOUNT for Discount is ACCOUNTS RECEIVABLE - TRADE since the Discount

is not DUE and PAYABLE (unless not earned). If the Discount is NOT ALLOWED enter a Credit

for the Discount using this SAME CODE. This will REDUCE the Expense Account and RAISE the

amount in Accounts Receivable.