|

P/Y - Y/E - Print Local Tax - by Empl. by City |

|

|

|

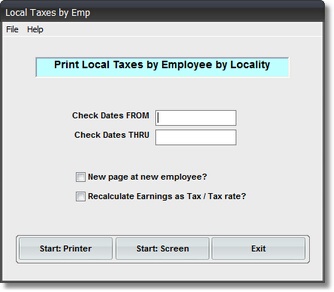

On the Payroll / Payroll Year End Menu select #2 - Print a Local Tax Report: by Employee by City.

The output produced is the EMPLOYEE LOCAL TAXES REPORT.

A. Enter Parameters

1. Enter CHECK DATES FROM (Required)

This is the BEGINNING CUTOFF DATE for inclusion of LOCAL TAX Records in this Report.

Any RECORD DATE EARLIER THAN THIS DATE is NOT included in Report Amounts

or Totals.

2. Enter CHECK DATES THRU (Required)

This is the ENDING CUTOFF DATE for inclusion of LOCAL TAX Records in this Report.

Any RECORD DATE LATER THAN THIS DATE is NOT included in Report Amounts or Totals.

3. NEW PAGE AT NEW EMPLOYEE Option

Click on this Check Box if you want each NEW EMPLOYEE to START PRINTING on a NEW PAGE.

This is useful if you put copies of this Report in EMPLOYEE FOLDERS..

4. RECALCULATE EARNINGS AS TAX / TAX RATE Check Box Option

This feature will RECOMPUTE TAXABLE EARNINGS based on TAX PAID so that

LOCAL TAX SPLITS will appear correct on Reports.

B. Select Print Option Note: Click on FILES at top left for Printer / Font Setup

Use the buttons in the box at bottom to select Print Destination.

You can use the Start: Screen Button to print to the Screen for a Display LOOKUP.

Use the Start: Printer Button to a get a printed EMPLOYEE LOCAL TAXES REPORT.

Use Exit to Return to the Menu without printing the Report.