|

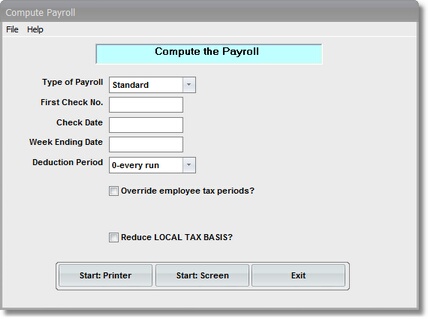

Pay Run - Compute Payroll |

|

|

|

On the Payroll \ Run a Payroll Menu select #2 - Compute the Payroll.

A. Enter Parameters

1. Select TYPE OF PAYROLL RUN.

You can select ONE of the following options from a Drop Down List Box:

Standard - This is your Regular Payroll Run Procedure

Reversal - This is a SPECIAL PROCEDURE to REVERSE a Check or Checks UPDATED in ERROR. All time is entered as it was originally, then this step is run with this option to create a NEGATIVE PAYROLL.

2. Enter the FIRST CHECK NUMBER to be printed during the Print Payroll Checks Run.

3. Enter the CHECK DATE to be printed on the Payroll Checks in Standard Date Format.

Pay PARTICULAR ATTENTION to this date, especially at Month End and Year End. This is the LEGAL DATE OF PAY considered by the IRS for Tax Reporting purposes.

4. Enter the WEEK ENDING DATE for this Pay Run in Standard Date Format..

This date is printed on Payroll and Job Labor Cost Reports. It also can be optionally used in printing some Craft/Union Reports.

5. Verify the DEDUCTION PERIOD displayed in the Drop Down List Box. If necessary click on the Down Arrow and select another option.

These options are tied to the FREQUENCY CODE used with MISCELLANEOUS DEDUCTIONS.If the MONTHLY DEDUCTIONS are to be taken out on this Pay Run, then Click on the MONTHLY option.

The default setting for this Parameter is - 0- EVERY RUN.

5. (Optional - DIRECT DEPOSIT)

B. Select Print Option

Use the buttons in the box at bottom to select Print Destination.

You can use the Start: Screen Button to print to the Screen for a Preliminary Control Total Check, or to to verify an Input Data Correction. BEFORE LEAVING THIS PROGRAM BE SURE to use the Start: Printer Button to a get a printed PAYROLL HOURS INPUT REPORT for your AUDIT TRAIL.