|

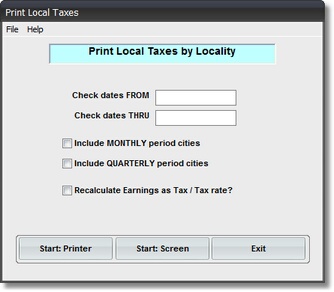

P/Y - M/E - Print City Tax Report |

|

|

|

On the Payroll / Payroll Month End Menu

select #4 - Print a City Tax Report.

The output produced is the LOCAL TAXES REPORT.

A. Enter Parameters

1. Enter CHECK DATES FROM (Required)

This is the BEGINNING CUTOFF DATE for inclusion of LOCAL TAX Records in this Report.

Any RECORD DATE EARLIER THAN THIS DATE is NOT included in Report Amounts

or Totals.

2. Enter CHECK DATES THRU (Required)

This is the ENDING CUTOFF DATE for inclusion of LOCAL TAX Records in this Report.

Any RECORD DATE LATER THAN THIS DATE is NOT included in Report Amounts or Totals.

3. INCLUDE MONTHLY PERIOD CITIES Check Box Option

Use this Check Box if you want those LOCALITIES included in this Report that are designated

as MONTHLY REPORTING.

4. INCLUDE QUARTERLY PERIOD CITIES Check Box Option

Use this Check Box if you want those LOCALITIES included in this Report that are designated

as QUARTERLY REPORTING. (You can have BOTH OPTIONS CHECKED in one run, so that

BOTH Monthly AND Quarterly Reporting Localities will be included in one run).

5. RECALCULATE EARNINGS AS TAX / TAX RATE Check Box Option

This feature will RECOMPUTE TAXABLE EARNINGS based on TAX PAID so that

LOCAL TAX SPLITS will appear correct on Reports.

B. Select Print Option Note: Click on FILES at top left for Printer / Font Setup

Use the buttons in the box at bottom to select Print Destination.

You can use the Start: Screen Button to print to the Screen for a Display LOOKUP.

Use the Start: Printer Button to a get a printed LOCAL TAXES REPORT.

Use Exit to Return to the Menu without printing the Report.