|

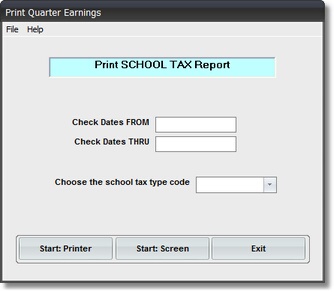

P/Y - M/E - Print School Tax Report |

|

|

|

SPECIAL NOTE: This Report is only used in states that have a SCHOOL DISTRICT TAX, over and

above LOCAL or CITY TAXES.

On the Payroll / Payroll Month End Menu

select #8 - Print a School Tax Report.

The output produced is the SCHOOL DISTRICT TAX REPORT.

A. Enter Parameters

1. Enter PRINT FROM DATE (Required)

This is the BEGINNING CUTOFF DATE for inclusion of LOCAL TAX Records in this

Report. Any RECORD DATE EARLIER THAN THIS DATE is NOT included in Report Amounts

or Totals.

2. Enter PRINT THRU DATE (Required)

This is the ENDING CUTOFF DATE for inclusion of LOCAL TAX Records in this Report.

Any RECORD DATE LATER THAN THIS DATE is NOT included in Report Amounts or Totals.

3. CHOOSE THE SCHOOL TAX TYPE CODE Selection

The Options in this Drop Down List Box are ALL THE DEDUCTION TYPE CODES in your

DEDUCTION TYPES MASTER FILE. Click on the one that is used for SCHOOL DISTRICT TAX.

B. Select Print Option Note: Click on FILES at top left for Printer / Font Setup

Use the buttons in the box at bottom to select Print Destination.

You can use the Start: Screen Button to print to the Screen for a Display LOOKUP.

Use the Start: Printer Button to a get a printed SCHOOL DISTRICT TAX REPORT.

Use Exit to Return to the Menu without printing the Report.