|

Job Cost Files - Add / Change / Remove |

|

|

|

A. Preparation of Input.

a. Contract Jobs

These are usually Jobs which were Bid and Awarded and require the MOST INTENSIVE

MANAGEMENT ATTENTION and REVIEW.

Normally the Job is broken down into PHASES or COST CATEGORIES, with ESTIMATED

HOURS and DOLLARS entered,which will be compared to ACTUAL HOURS and DOLLARS

as they are incurred.

This JOB CLASSIFICATION is automatically setup in the TOTAL JOB STATUS File for Financial

Reporting.

LABOR BURDEN can be automatically calculated and applied according to parameters

set in the JOB CLASS MASTER Record, or can be overridden by a Percentage entered

in the JOB MASTER Record.

Information required for New Contract Job setup:

Job Code Job Name & Address Government Reports required

Tax Jurisdictions Start Date Contract Amount

Labor Burden Sq. Ft. (optional) Job Class

Sales Location (for Sales Tax)

------------------------------------------------------------------------------------------------------------------

COST CODE BREAKDOWNS (usually comes from Estimate)

Cost Code Code Description Estimated Hours & Dollars

Workman's Comp Code (optional) Quantity & Units (optional)

------------------------------

b. Non-contract Jobs

These are usually smaller Jobs, where DETAILED COST ANALYSIS is NOT desired by

Management.

Normally it is sufficient to gather Labor Hours and Dollars, Material Costs and Other

Expenses for the Job as a whole. Estimates may be entered for each Cost Category

(hours, labor, material, etc.) or omitted.

This Job Class is NOT setup in the TOTAL JOB STATUS File.

LABOR BURDEN can be automatically calculated and applied according to parameters

set in the JOB CLASS MASTER Record, or can be overridden by a Percentage entered

in the JOB MASTER Record.

Information required for New Non-contract Job setup:

Job Code Job Name & Address

Tax Jurisdictions

Labor Burden Job Class

Sales Location (for Sales Tax)

NO COST CODE BREAKDOWN (make this selection on Cost Code Selection Screen)

------------------------------------------------------------------------

c. Indirect Labor and Administrative Overhead Jobs

These are Jobs setup to capture Labor and Other Costs associated with Indirect Job

Cost activities such as; Vehicle Expense & Maintenance, Equipment, Facilities, Office

Expenses, General Supervision, Estimating, etc.

Normally Labor Hours and Dollars, Material Costs and Other Expenses are gathered.

Estimates may be entered for a YEARLY BUDGET and compared to ACTUAL EXPENSES.

(at year end you would remove the Jobs and reopen them to zero out the costs).

This Job Class is NOT setup in the TOTAL JOB STATUS File.

LABOR BURDEN can be automatically calculated and applied according to parameters

set in the JOB CLASS MASTER Record, can be overridden by a Percentage entered

in the JOB MASTER Record, or omitted.

Information required for New Indirect Cost Job setup:

Job Code Job Name

Tax Jurisdictions

Labor Burden Job Class

------------------------------------------------------------------------------------------------------------------

NO COST CODE BREAKDOWN (make this selection on Cost Code Selection Screen)

(Cost Codes COULD be setup to keep track of INDIVIDUAL PIECES OF EQUIPMENT,

Vehicles, or Administrative Functions).

=========================================================================

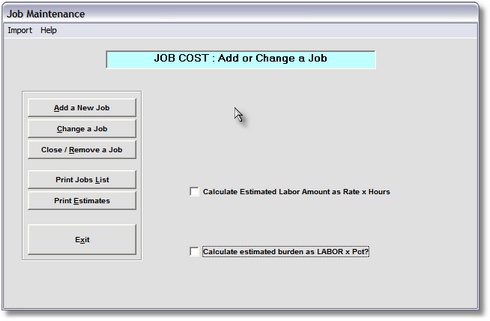

Job Master Add / Change / Remove

On the Job Cost / Job Files Menu

select #1 - Add / Change / Remove Jobs.

B. ADD A NEW JOB

This selection will bring up.the Job Maintenance Control Panel.

Here you can click on the ADD A NEW JOB Button to start the Procedure

by entering the NEW JOB CODE.

For details Click on ADD A NEW JOB.

C. CHANGE AN EXISTING JOB

To CHANGE data that already exists in a PREVIOUSLY ADDED Job,

you can click on the CHANGE A JOB Button to start the Procedure

by entering the EXISTING JOB CODE.

For details Click on CHANGE A JOB.

D. REMOVE AN EXISTING JOB

To REMOVE a Job that exists in the Job Cost Files,

you can click on the REMOVE A JOB Button to bring

up the REMOVE SELECTION SCREEN.

For details Click on REMOVE A JOB.