|

J/C Misc - Misc J/C Entry |

|

|

|

Miscellaneous Job Cost is primarily used to TRANSFER JOB COST AMOUNTS from

ONE JOB and/or COST CODE to ANOTHER. This is usually the result of posting a

Record to the WRONG Job Number or Cost Code or both.

Another possible use for this tool is to move cost from a JOB to INVENTORY, or FROM

INVENTORY to a JOB. Also, if cost was MISAPPLIED to JOB, it can be REMOVED and

charged to a General Ledger Account.

On the Job Cost / Misc Job Cost Menu make Selection #1 - Enter Misc Job Costs

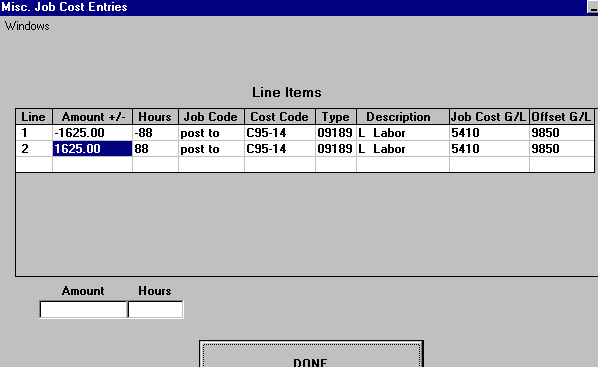

The LINE ITEM SELECTION SCREEN will appear with any records previously entered

BUT NOT YET UPDATED, as in the example below:

In the above example you can Click on Line # 1 or Line #2 to bring up those Records for CORRECTION, or you can Click on the BLANK LINE at bottom of Grid to bring up an EMPTY

SCREEN so you can ADD A NEW MISC. JOB COST Record.

The AMOUNT and HOURS Boxes at lower left show a RUNNING TOTAL of all entries in this

File. In the case of Job Cost Transfers these blocks should be BLANK because all entries

should OFFSET each other. For other purposes you can use these for CONTROL TOTALS.

The WINDOWS Menu at upper left make the GENERAL LEDGER ACCOUNTS, DEPARTMENTS

and JOB MAINTENANCE functions available to you without leaving this Screen.

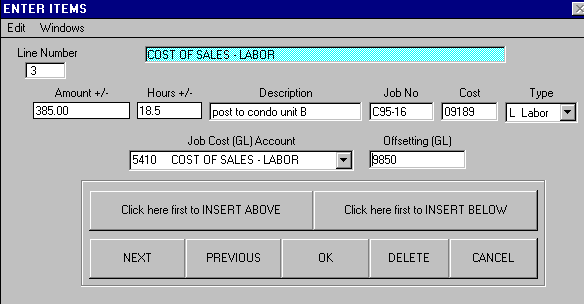

After filling in the Record, the Screen looks like the below example:

Click on the above MENU ITEMS, BOXES and BUTTONS for explanations.

If you have an entry that is SIMILAR to the LAST ENTRY you made, it is FASTER to use the Edit

Menu or F2 to DUPLICATE the PREVIOUS RECORD, then make changes.

Keep in mind that a POSITIVE AMOUNT Entry will DEBIT the Job Cost Account you picked from

the Drop Down List Box (only Job Cost Accounts show in this Box), and will CREDIT the

Offsetting Account you entered.

Of course, a NEGATIVE AMOUNT Entry will do the REVERSE, Credit the Job Cost Account and

Debit the Offsetting Account.

Examples: Debit Credit

Transfer Job Cost Job to be Charged + Amount Job Cost Acct Other Expense

Job to be Credited - Amount Job Cost Acct Other Expense

(Net effect on General Ledger is ZERO)

Move to Inventory Job to be CREDITED - Amount Job Cost Acct INVENTORY

(REDUCES Job Cost and INCREASES Inventory)

From Inventory Job to be CHARGED + Amount Job Cost Acct INVENTORY

(INCREASES Job Cost and REDUCES Inventory)