|

Federal & State Tax Files |

|

|

|

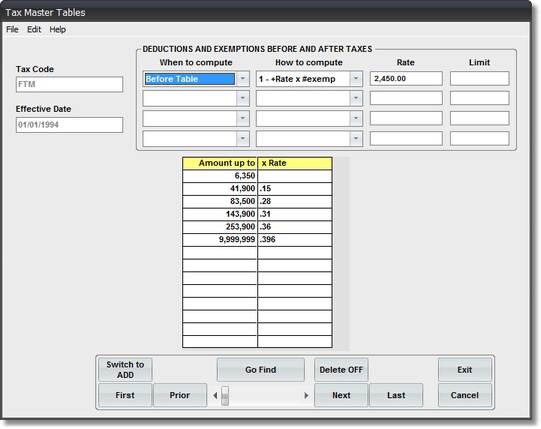

A. Purpose:

For Federal and State Income Tax Computation Tables; Description Exemptions & Allowances, Rate Tables.

B. Example Updates:

Add - Working in a New State, State Income Tax Rates or Computation method changed. (Federal done automatically as part of Year End Update).

Change - NOT USED If a Tax changes a NEW RECORD is added to the File. (necessary because Tax Tables are DATE SENSATIVE, allowing for Payroll runs in prior periods).

Delete - NOT ALLOWED

C. Procedure:

D. Required Fields:

(all fields required by Tax Structure - see below) |

E. Field Descriptions: